Since the 1990s, when China began localizing wind turbine production, direct-drive and doubly-fed have become the two mainstream technology routes in the market, each with its own advantages. Meanwhile, semi-direct-drive has quietly caught up — once questioned, it has gradually revealed unique benefits as the industry explores and innovates for cost reduction in the era of large-megawatt, grid-parity wind power. The pace of industry progress has never slowed. With continuous technological innovation and cost-reduction pressure, both onshore and offshore wind power faced grid parity in 2022. How will wind turbine technology routes shape up in the future?

Era of Slim Margins: Wind Turbine Prices Hit New Lows

In 2021, China’s onshore wind power officially entered the grid-parity era. Amid fierce market competition and cost pressures, the turbine market saw significant price cuts, with most turbines priced below 3,000 RMB/kW. In September this year, at the CGN Qujing wind farm procurement bidding in Yunnan, Dongfang Electric, specializing in doubly-fed turbines, offered a record-low price of 1,880 RMB/kW.

In October, Longyuan Power’s Jiyuan Wind Power’s Qiduntan 200MW project in Gansu announced that Goldwind won the bid with a direct-drive turbine price of about 2,187 RMB/kW — setting a new record for the lowest bid price for direct-drive turbines, and for the first time falling below that of doubly-fed turbines. Recently, eight OEMs bid for the Gansu Yumen Mahuangtan Phase I 200MW project, with the lowest bid at 2,300 RMB/kW. Excluding tower costs, turbine prices hovered around 1,800–1,900 RMB/kW — once again breaking industry price records! Mingyang Smart Energy’s pre-awarded bid was 579.4 million RMB, equivalent to 2,897 RMB/kW (since 2009, Mingyang has adhered to the semi-direct-drive route for 12 years).

Price competition in the market continues. Industry insiders revealed that this year’s bidding trends are already clear: price cuts for doubly-fed turbines outpaced direct-drive. Average prices for doubly-fed turbines dropped from 4,400 RMB/kW to about 2,200 RMB/kW, almost halved. Under the same conditions, direct-drive turbines remain about 200–300 RMB/kW more expensive.

At the same time, it’s worth noting that wind turbines are large, high-precision, high-value heavy industrial equipment. The gearbox is among the components most prone to overload and failure. Direct-drive turbines, without a gearbox, reduce transmission loss and O&M costs. However, compared to doubly-fed, for the same capacity, direct-drive turbines are larger and heavier, with higher hoisting and transport costs.

Driven by cost reduction and efficiency improvement, turbine sizes and weights continue to increase. While turbine prices fall, raw material costs have surged, creating dual pressures that force technological innovation. Semi-direct-drive turbines combine the features of both: structurally similar to doubly-fed with a gearbox, while reducing gearbox wear by operating at lower speeds. Current designs featuring no main shaft also resemble direct-drive in appearance. Simply put — mechanically like doubly-fed, electrically like direct-drive. Additionally, to reduce nacelle weight, most semi-direct-drive turbines are compact models, using less material per kW and reducing total turbine weight and size.

Three-Way Standoff — Market Demand Decides

Direct-drive and doubly-fed each have their merits and weaknesses. Doubly-fed turbines hold the main advantage due to mature technology and low prices, with over 60% of global installed turbines being doubly-fed. Domestically too, the dominance of doubly-fed proves its reliability. Direct-drive turbines, with no gearbox and no oil leak risks, appeal for their advantages — but considering grid-parity pricing, their high costs and manufacturing challenges remain fatal drawbacks. As capacities increase, the consumption of non-ferrous and rare metals rises, making large-capacity direct-drive development difficult. In low-wind-speed, parity areas, current direct-drive tech still struggles to achieve profitable costs.

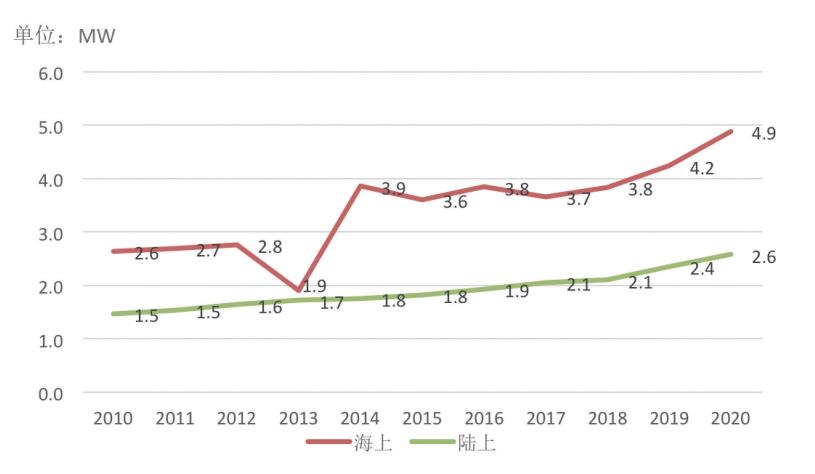

Following market trends, both onshore and offshore turbines are scaling up — onshore 6.X–7.XMW, offshore 10MW+ models emerged continuously from 2021. Many OEMs are promoting “shared platform for onshore and offshore” product lines.

As large-megawatt turbines become mainstream, challenges like increased size and weight, transportation difficulties, and dual pressures of cost and reliability strain traditional technology paths.

Beyond doubly-fed and direct-drive, semi-direct-drive models have gained favor under the dual demands of large-scale turbines and cost reduction, ushering in a new opportunity. From “wind power +” to zero-carbon concepts, annual wind expos hint at future trends, with many new models highlighting semi-direct-drive.

Statistics show that at the 2021 Beijing Wind Energy Exhibition, major domestic OEMs launched 50 new turbine models. Even Goldwind, the leader in domestic direct-drive turbines, unveiled 16 new medium-speed permanent magnet turbines. Details are as follows:

At present, doubly-fed models have essentially exited offshore wind power markets. Compared to direct-drive, semi-direct-drive offers clear advantages: lighter weight, higher generation efficiency, and better cost competitiveness.

A gearbox manufacturer insider said semi-direct-drive represents a major global wind power trend, and China’s semi-direct-drive adoption rate will surpass the global average. According to WoodMac forecasts, by 2029, the market share of semi-direct-drive (medium-speed) turbines in global onshore and offshore wind markets will reach 34% and 45%, respectively — potentially taking the second place in global technology paths.

The Future Is Here — Only Innovation Can Break Through

It’s understood that most of the top domestic OEMs are evaluating whether to pivot to or add semi-direct-drive to their technology roadmaps. The third force is catching up. Semi-direct-drive tech combines the high stability of direct-drive and low cost of doubly-fed, better suiting the trends of turbine scaling and offshore wind development. Industry insiders noted that judging by current offshore wind OEM deployment, semi-direct-drive has become a relatively mainstream technology route. For onshore wind, continuous technological breakthroughs are being made. In the future, direct-drive, doubly-fed, and semi-direct-drive will likely compete side by side on the same stage.

With the “dual carbon” goal proposed, wind power will become a main force. Whether in grid-parity mega bases, wind power for rural areas, or offshore wind, higher generation output, greater reliability, and relatively lower costs remain the industry’s key priorities.

Technical capability is the core competitive advantage. The wind industry’s exploration for lower LCOE continues. The future is here — who will lead remains to be seen.